percent change in working capital formula

It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling. Change in Net Working Capital NWC Prior Period NWC Current Period NWC.

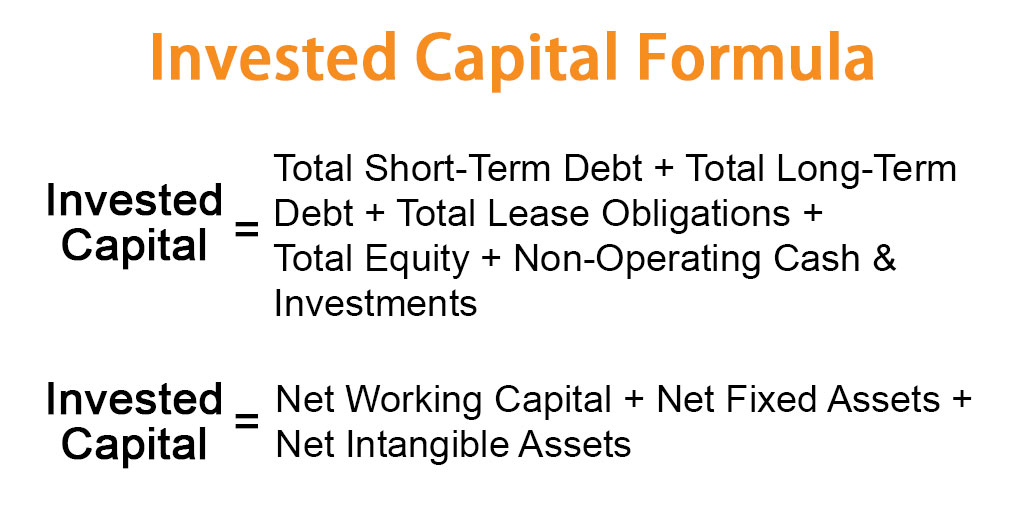

Invested Capital Formula Calculator Examples With Excel Template

Select cell C3 click on the lower right corner of cell C3 and drag it down to cell C13.

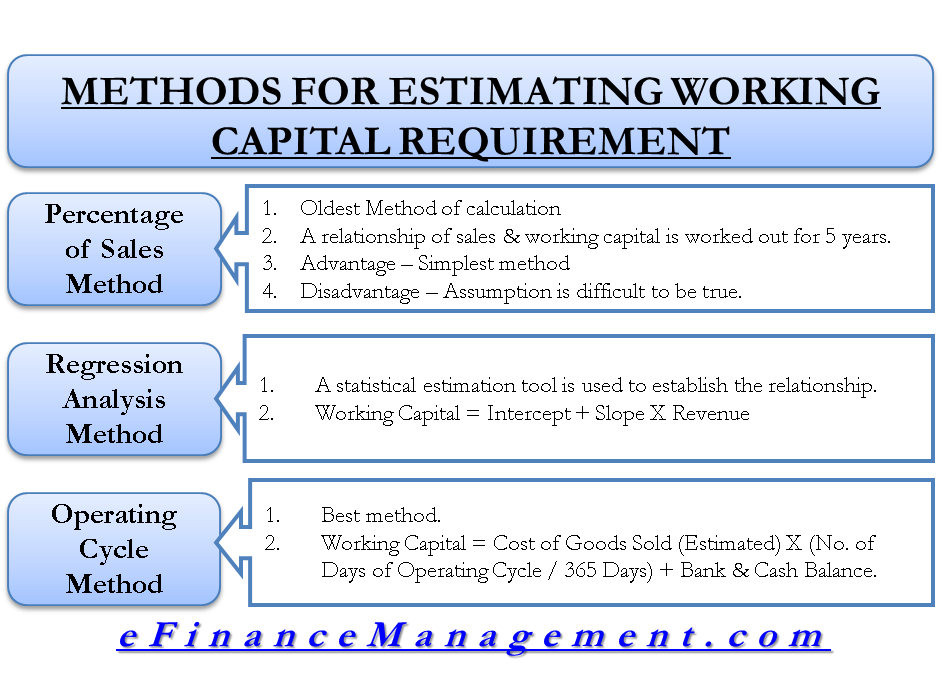

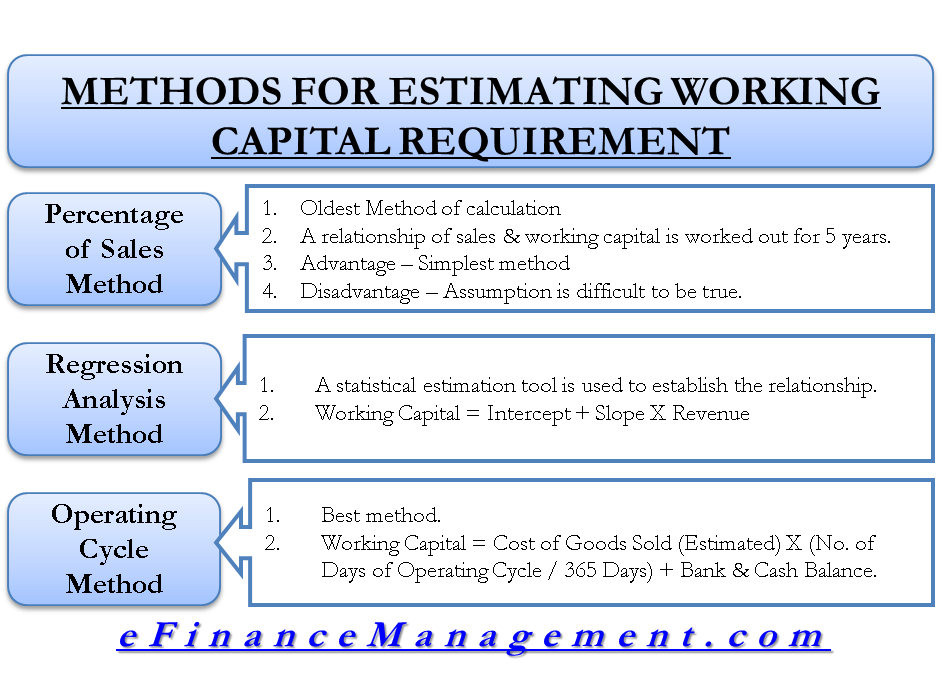

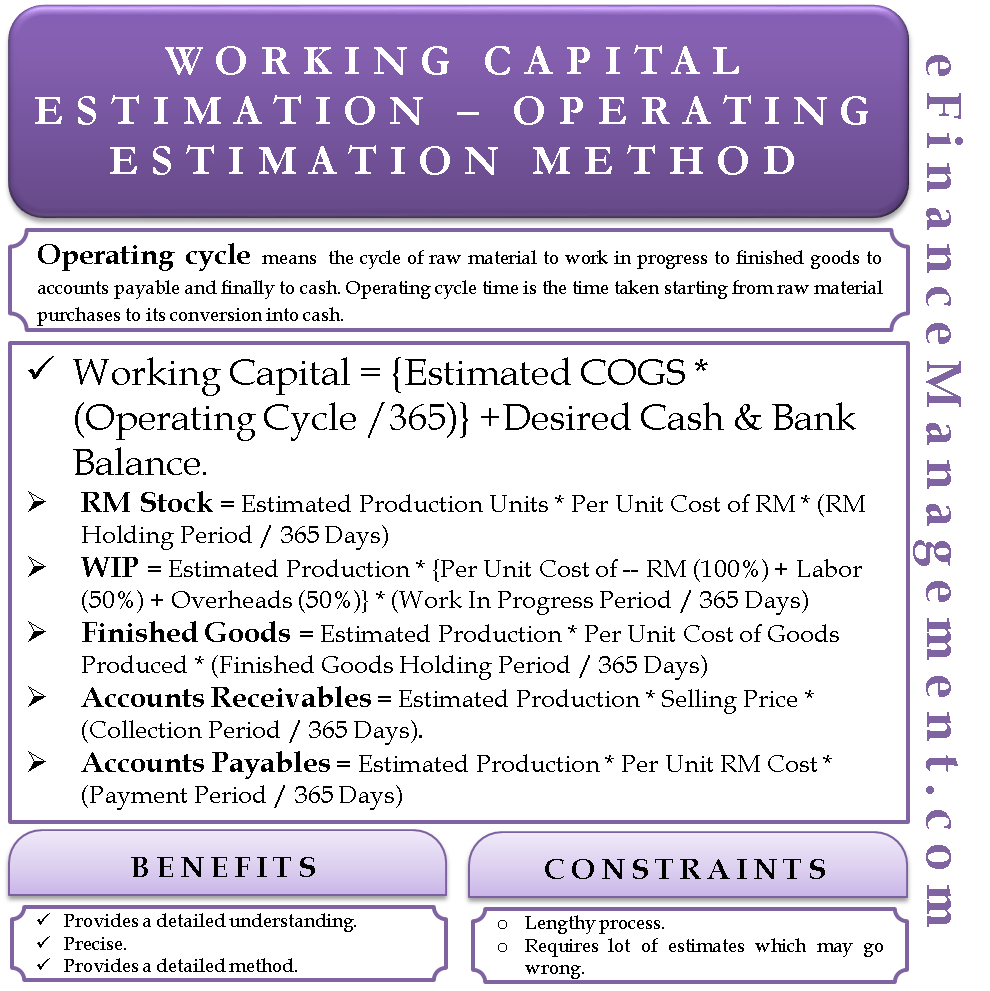

. Based on the above steps we can see that the working capital cycle formula is. Percentage of Sales Method Formula Component of Working Capital 100 Sales of the Year. Current assets and liabilities are.

Working Capital Cycle Sample Calculation. This presentation gives investors and creditors more information to analyze about the company. 18819105991263-13102 19192 34245.

As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. You can find the net working ratio with this simple calculation. Finally the Change in Working as calculated manually on the Balance Sheet will rarely if ever match the figure reported by the company on its Cash Flow Statement.

Percentage change formula is. Working capital Inventory Accounts receivable Accounts payable. Heres an example for Target.

Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. How to Calculate Working Capital. Select cell C3 and enter the formula shown below.

Change in Net Working Capital is calculated using the formula given below. The definition assumes cash is a non-operating asset and. Calculating the metric known as the current ratio can also be useful.

Now we will calculate the change in profit. 03 100 30. Working Capital Cycle 85 20 90 15.

This will give you a decimal. Working Capital Cycle Formula. 105 35 03 See our division page for instruction and examples of division Finally to get the percentage we multiply the answer by 100.

The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. To work out the increase as a percentage it is now necessary to divide the increase by the original January number. Notice the different language for the assets and liabilities.

Changes in working capital 317696 151910 165786 thousand. The percent change formula is used very often in Excel. The forecasted sales figure for the year 2015 is 600.

Current assets - current liabilities and expenses total assets You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow. If the result is positive then it is an increase. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period.

Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. It can get confusing. The above definition of working capital is a narrow definition representing the day to day operating working capital required by the business.

The sales for 2014 are 400. New number Previous Year Sale. Finally the percentage change formula can be expressed as the change increase or decrease in value step 3 divided by its original value step 1 which is then multiplied by 100 as shown below.

What is Financial Modeling Financial modeling is performed in Excel to. Change in Net Working Capital 4396000. Working capital is calculated simply by subtracting current liabilities from current assets.

Increase Increase Original Number 100. Net working capital is defined as current assets minus current liabilities. Now we will calculate Hormels changes in working capital.

Change in Inventory 9497 8992 505. Therefore Microsofts TTM owner earnings come out to be. This simply means moving the decimal place two columns to the right.

Since the change in working capital is positive you add it back to Free Cash Flow. November 13 2021. Change in working capital is a cash flow item that reflects the actual cash used to operate the business.

Inventory days 85. Working Capital Turnover Ratio Meaning Formula Calculation Change In Net Working Capital Nwc Formula And Calculator. Decimal decrease initial value Multiply the decimal you receive by 100 to get a percentage.

Calculation of percentage change in a profit can be done as follows-. For example to calculate the Monthly Change and Total Change. It means the change in current assets minus the change in current liabilities.

Consider the following balance sheet for the year 2014 as an example. A management goal is to reduce any upward changes in working capital thereby minimizing the need to acquire additional funding. Percentage of Sales Method Example.

A change in working capital is the difference in the net working capital amount from one accounting period to the next. Now that we know the steps in the cycle and the formula lets calculate an example based on the above information. Payable days 90.

On the Home tab in the Number group apply a Percentage format. Change in Working capital does mean actual change in value year over year ie. Increase decimal 100 This calculation is meant to represent a percentage decrease but if the percentage you get is negative that would mean that the percentage change is an increase.

Change in NWC Formula. Next divide the increase by the original number and multiply the answer by 100. 175500-294944 175500 100.

Both of these current accounts are stated separately from their respective long-term accounts on the balance sheet. Percentage Change New Value Original Value Original Value 100. P e r c e n t a g e C h a n g e N e w V a l u e O l d V a l u e O l d V a l u e 100.

Change in Net Working Capital 6710000 2314000. Relevance and Uses of Percentage Change Formula. The sales for 2014 are 400.

The net working capital ratio measures the proportion of a businesss short-term net cash to its assets. Old Number Current Year Sale. The working capital ratio is calculated by dividing current assets by current liabilities.

If the result is. Working Capital Current Assets Current Liabilities. Percentage of Sales Method Formula Component of Working Capital 100 Sales of the Year.

The working capital calculation is given by the following formula. Receivable days 20.

Changes In Net Working Capital All You Need To Know

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital What It Is And How To Calculate It Efficy

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Change In Net Working Capital Nwc Formula And Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Change In Net Working Capital Nwc Formula And Calculator

Methods For Estimating Working Capital Requirement

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital Estimation Operating Cycle Method

Working Capital Ratio Analysis Example Of Working Capital Ratio

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)