colorado estate tax exemption

In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. Until 2005 a tax credit was allowed for federal estate.

A New Era In Death And Estate Taxes

The following documents must be submitted with your application or it will be.

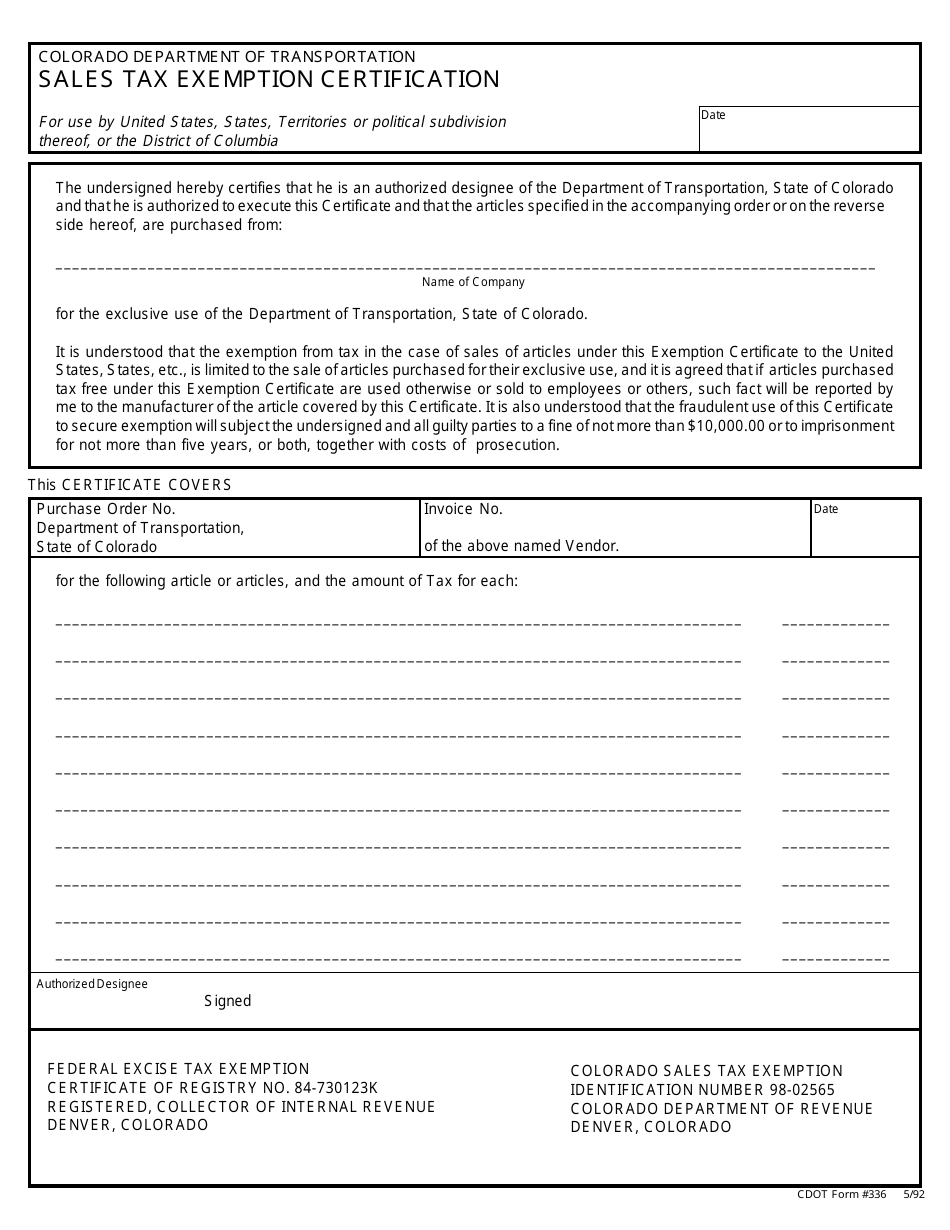

. Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. A retailer may also accept from an out-of-state purchaser a fully completed Standard Colorado Affidavit of Exempt Sale DR 5002 Sales Tax Exemption Certificate DR 0563 or Multistate. Learn all about Colorado Acres real estate tax.

You can also own a life. Whether you are already a resident or just considering moving to Colorado Acres to live or invest in real estate estimate local property. A state inheritance tax was enacted in Colorado in 1927.

There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city. Section 6 creates an income tax credit that is available for 10 tax years beginning on January 1 2020 for a. If the exemption is made available in the future seniors must reapply for it.

Otherwise known as the Generation-Skipping Transfer Tax. A state inheritance tax was enacted in Colorado in 1927. Property taxes in Colorado are definitely on the low.

Thats especially true for any situation involving. When you file through the Revenue Online service you will be prompted to provide the deductions information and it will become part of the e-filed return. Corporate partnership or other entity for estate planning.

There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability homestead exemption that is equal to 50 of the. 175 for Applications for. Increases the maximum amount of actual value of the owner-occupied residence of a qualifying senior or veteran with a.

Withdrawn Prior to RC Hearing. For property tax years commencing on or after January 1 2022 the bill. You do not have to be the sole owner of the property.

Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicated. A property tax exemption is available for senior Colorado residents or surviving spouses provided they meet the requirements. Timely filings with a 75 filing fee per report are due by April 15.

The tax year for which you are seeking the exemption. Late reports filed after the April 15 deadline must be accompanied by the 250 late filing fee. 2373 Central Park Blvd Suite 100 Denver Colorado 80238 hello.

If the return is filed on paper the total. A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

Colorado statute exempts from state and state-collected sales tax all sales to the United States government and the state of Colorado its departments and institutions and its political. 2021-2022 92 - Social Security Income Exemption from State Income Tax. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to.

Until 2005 a tax credit was allowed for federal estate. If you are concerned about Colorados Estate Tax we can help. You can own it with your spouse or with someone else.

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Foreign Homebuyers Tax Exemption Comes Too Late For Some Cbc News

Cdot Form 336 Download Printable Pdf Or Fill Online Sales Tax Exemption Certification Colorado Templateroller

Requirements For Tax Exemption Tax Exempt Organizations

Seniors Can Apply For The Colorado Senior Property Tax Exemption Steamboat Radio

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Eight Things You Need To Know About The Death Tax Before You Die

How To Avoid Estate Taxes With A Trust

2020 Estate Planning Update Helsell Fetterman

24 Best Tax Exemption Services To Buy Online Fiverr

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Don T Die In Nebraska How The County Inheritance Tax Works

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

So You Used Up All Of Your Gift And Estate Tax Exemption Now What

Sales And Use Tax In Colorado Manufacturing Sales Tax Exemption With New Public Service Case Report Lorman Education Services